End of the Big Short Explained

At the end of the Oscar-nominated film The Big Short viewers were warned that little has changed and these new but essentially the same investments would lead to. There is a person on the other side of the trade who bets that the investment will go up in value.

He also included the example of Warren.

:max_bytes(150000):strip_icc()/picture-53668-1413912494-5bfc2a95c9e77c005143c916.png)

. Three separate but parallel stories of the US mortgage housing crisis of 2005 are told. I hope you enjoy. IMDb Plot Summary.

I figure a lot of people can relate to that so I made a video explaining exactly what happened during the 2008 financial crisis and what the protagonists did amidst the housing bubble. The Big Short the 2015 Oscar winning screenplay by Charles Randolph and Adam McKay. Based on Michael Lewiss New York Times bestseller by the same title the film tells the story of six contrarian traders who sniffed out the housing crash before virtually anyone else.

In their research they discover how flawed and corrupt the market is. The titular big short in The Big Short refers to the tradinginvestment practice of shorting or selling short. The Big Short is a 2015 American biographical comedy-drama film directed by Adam McKay.

The titular big short in The Big Short refers to the tradinginvestment practice of shorting or selling short. Written by McKay and Charles Randolph it is based on the 2010 book The Big Short. When you short somethingusually a financial security like a stockit means you borrow it and sell it on the open market with the aim of buying it back later at a lower price and pocketing the difference as a profit.

The Big Short tells the story of four. The big short ending explained. If you grasp that then youll be able to enjoy the 5-time Oscar nominated film.

The Big Short of the title is that the characters are all taking a huge bet that an industry considered stable and a goldmine is about to tank and that theyre the only people who have noticed. Oscar-nominated film The Big Short explains the complex financial instruments that helped fuel the financial crisis of 2007-2008. When you short somethingusually a financial security like a.

I dont know VinnieThey will be blaming immigrants and poor peopleAudio in the end credit was edited so the entire video would not be mut. In 2006-2007 a group of investors bet against the US mortgage market. The Big Short Hollywoods star-studded effort to explain the financial meltdown of 2008 was nominated this week for the Academy Award for Best Picture.

A credit default swap sounds complicated but its just insurance. Of course the details are much more complicated and comprise an avalanche of purposefully obscure financial acronyms a glut of. Investors thought Well since Im buying this risky tranche of a CDO I might want to hedge my bets a bit and buy insurance in case it fails.

20 2016 America has come a long way since the 2008 financial crisis and the countrys housing markets are on track to have its best. The complication for the Steve Carrell character and the Brad Pitt character is that they both understand the massive human implications. And if there were an Oscar for Best.

There is no end and there shouldnt be any conclusion. It shows that Roger was a pilot of the Big O robot whereas Alex was a pilot of Big-Fau. Their foresight helped them make gobs of money while Wall Street.

Httpamznto2ANqaO1The Big Short is one of my favorite movies that came out last year. Four denizens in the world of high-finance predict the credit and housing bubble collapse of the mid-2000s and decide to take on the big banks for their greed and lack of foresight. The Big Short tells the story of the financial crisis through a group of outsiders and misfits who predicted the housing collapse and became fabulously rich.

Burry emphasized that young investors should study up on their predecessors but he reminds them its a fools errand to sink into past thinking too much. The reason behind it is the ending scene of the different acts. In the end all of them go to a friction world where Roger Smith does not want to forget his good memories.

And if there were an Oscar for Best. The Big Short Ends With A Big Warning By Melissah Yang Jan. I was surprised however when The Big Short a movie claiming to explain the housing collapse so as to prevent another one left out not.

Thats what a credit default swap did. Very simple but they have a key role to explain the Big Short. In the end that may be the movies greatest success.

Directed by Adam McKay The Big Short chronicles the years leading up to the 2007-08 global economic crisis focusing on several financial professionals based on actual individuals who predicted and profited from the collapse. Inside the Doomsday Machine by Michael Lewis showing how the financial crisis of 20072008 was triggered by the United States housing bubble. Big O Ending Explained.

The big financial meltdown is finally getting its star turn on the big screen with the release of The Big Short. I loved the movie The Big Short when I saw it in theaters a while ago however I didnt immediately understand everything that was going on. Michael Burry an eccentric ex-physician turned one-eyed Scion Capital hedge fund manager has traded.

The Big Short is a 2015 film adaptation of author Michael Lewiss best-selling book of the same name.

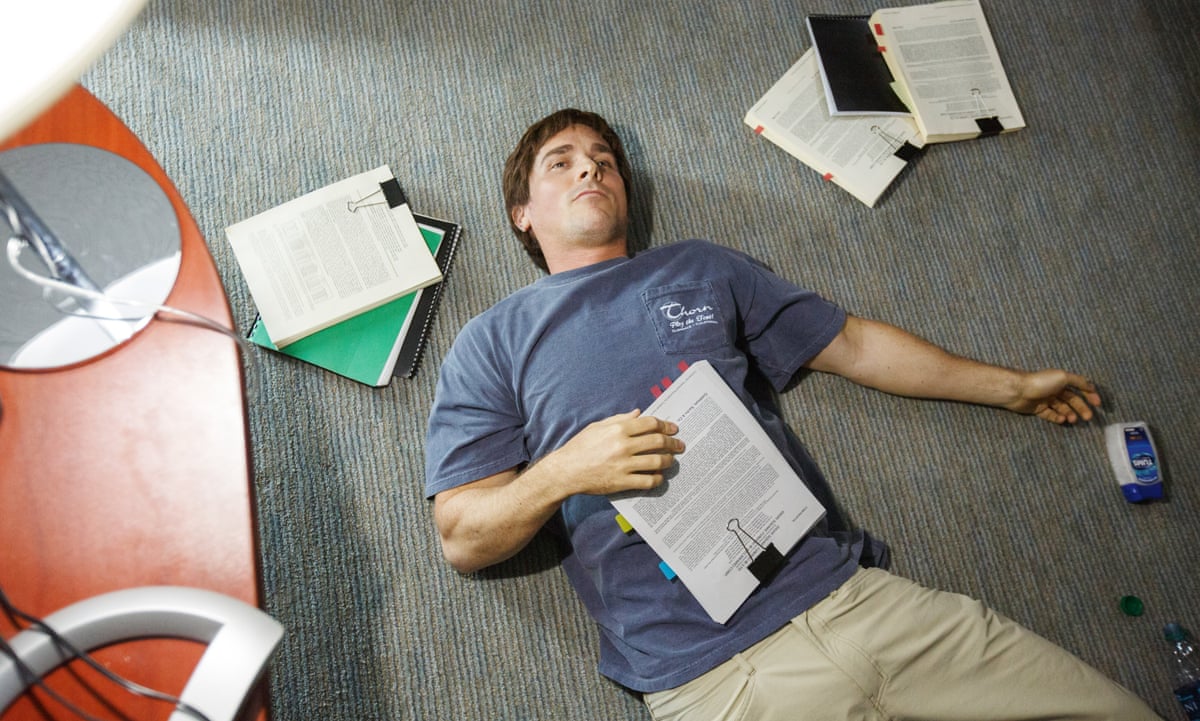

How Historically Accurate Is The Big Short The Big Short The Guardian

How Historically Accurate Is The Big Short The Big Short The Guardian

/shutterstock_103212854_brad-5bfc3cef4cedfd0026c5792f.jpg)

Comments

Post a Comment